Smartphones have transformed the way we perform most of our tasks. Mobile applications and portals fast-track mundane tasks in the most innovative way––from something as basic as looking for a public restroom to availing online education. Everything is just a click away.

Fintech has played a similar role for banking; it has revolutionized the way people access various financial services.

What is Fintech?

The word fintech (fin+tech) literally means financial technology.

It refers to automation and technological innovation in the finance sector. Fintech essentially seeks to transfer control to the customers by providing alternatives to traditional financial practices.

Crowdfunding sites, cryptocurrency, stock-trading and budgeting applications, mobile banking, and payments are all examples of fintech.

Owing to fintech, areas without banking provisions can now handle their funds and apply for loans from the comfort of their homes. It has empowered users to be less dependent on the bureaucratic banking system and manage their own finances.

According to Invest India, our country is among the fastest to adopt fintech services. It goes without saying, then, that fintech companies are more relevant in India than in other places.

However, with an industry size of 2.4 billion dollars, there is no doubt that dealing with client requests and streamlining customer service operations must be quite a feat.

This is where cloud telephony comes into the picture. IVR systems make fintech solutions convenient for consumers.

You may wonder how. Let’s start with the basics.

What is an Interactive Voice Response?

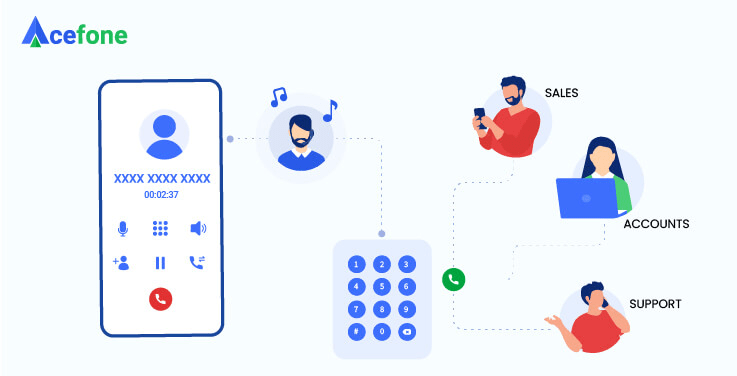

IVR, or Interactive Voice Response, refers to a service that reroutes customer calls to relevant agents, on the basis of their concerns and keyboard inputs.

For example, if a consumer calls to register a complaint, they will first be greeted with a prerecorded message and then presented with a list of options— “Press 1 for product information, press 2 to talk to an agent.” Once they make a choice, the IVR redirects the call to the assigned agent.

Acting as a receptionist, an IVR system facilitates higher first contact conflict resolution. It also reduces wait times and enhances customer experience.

While all of this is impressive, you might wonder how an IVR number helps improve fintech services. Let’s look at the various applications possible:

1. Information About Loans and Other Procedures

Loans are a big fiscal responsibility and customers like doing their research in advance. To gain more information, contact centers are often their primary source of information.

Interested clients call to inquire about the various loans, interest rates, and other specifics. It is imperative that the caller is connected to the right agent to save time and ensure that comprehensive knowledge is delivered.

IVR system routes the call according to the keyboard input and connects to the best-suited representative.

2. Checking Up on Account Balances and Verifying Credentials

Going to the bank every time one wishes to check their account balance, change their debit/credit card pinks, or for any other basic tasks can be bothersome.

With an IVR, customers need only follow very few steps. Within a matter of seconds, their personal information gets verified and their request is registered simultaneously. Post identity authentication, they’re able to access or update their account information. Identity verification processes facilitated by IVR systems ensure secure and efficient handling of customer data, reducing the risk of unauthorized access.

3. Redressing Customers’ Complaints

Consumers often call contact centers to complain about unsatisfactory services. These complaints make fintech businesses aware of their shortcomings and can strive to improve their operations. IVRs make this process easier for both parties.

For example, if you paid through a mobile wallet but didn’t get a notification, you could inform the contact center and register your complaint over the IVR system or even get it resolved then and there. This is how an IVR-powered contact center can provide consumers with a better experience.

4. Sending Reminders to People

Contact centers don’t just receive calls from customers. They also send out reminders. Fintech companies that wish to reach out to consumers, especially about payment-related delays, can make use of an IVR number.

Customers that have instalments due soon or have missed a due date can be reminded via targeted calls. Companies can also pre-record these statements and schedule them to be sent to a customer near the due date, or after in case of a missed payment.

5. Making Payments

There was a time when making payments involved standing in a long queue and hours of waiting. However, now, payments can be made through IVR. You can call your bank, select the payment option from the IVR menu, provide your credentials and voila! Payments can be handled simply.

6. Deactivate Debit/Credit Card Operations

Losing a debit or credit card is not a hard thing to do. To avoid theft, it is crucial to get your card blocked immediately. All the while you wait in the queue for the live agent, your data remains vulnerable—you can simply use an IVR menu to ask for the deactivation of the service. Simple, efficient and quick.

Why Use an IVR Number?

We have seen various applications of the IVR system and how it is revolutionizing fintech businesses for the customers. However, we must also discuss the various benefits and features that make the IVR system so desirable. How does the technology serve you for all these needs?

1) CRM Integration

You can integrate IVR with CRM (Customer Relationship Management) which will allow your agents to receive information provided by your consumers before they connect. This helps the agents to be prepared for the consumer’s request and saves time, enhancing customer relations.

2) Call Rerouting

True to the original purpose of the system, an IVR number can help direct a consumer call to the preferred agent. This encourages first point query resolution, saves time and efforts for both parties. For example, agent X receives all calls for approvals and agent B receives verification requests. So, agent A can reroute the call to B for verification and take up the next caller in line.

3) Independent of Internet

In an economically divided country like India, several areas are devoid of an Internet connection or are supplied with an unstable one. An IVR number works only on telephony services and requires only a call from the customers’ end, making it more inclusive of a varied audience.

4) Bank Within the Reach

Much like the Internet issue, several areas in the country lack formal banking systems. The technology helps people in these areas as well.

5) No Need of Receptionist

An IVR number eliminates the need for a physical receptionist and does a better job than a human could. Also, there are comparatively lesser chances of mistakes being made by the machine. Furthermore, it greets your users and guides them through the processes much like any other attendant.

Conclusion

Much like fintech has carved a new path for financial services, IVR solutions have done the same for fintech businesses. The ease of operations and inclusivity of audiences makes it a much desirable system.

It can handle a plethora of issues––from activations or deactivations and payments to complaint resolution and reminders. With a technology so simple yet so capable, a fintech company is equipped to serve its customers through any circumstances.

Furthermore, an IVR number is really easy to set up and requires no bulky hardware or infrastructure. It’s the one-stop solution to all your consumer service activities. Get one and push yourself above the standards of your competitors!

Equip yourself with an IVR number using Acefone and revolutionize your fintech company.