As a BFSI player, how do you stand out in today’s crowded market?

As technology continues to progress, customer expectations are also evolving. According to a McKinsey study, your customers are likely to be 20% more satisfied with digital usage. Other than digitalization, trends like hyper-personalization and open banking are taking their course. Hence, it is high time to rethink your approach to acquiring and retaining clients.

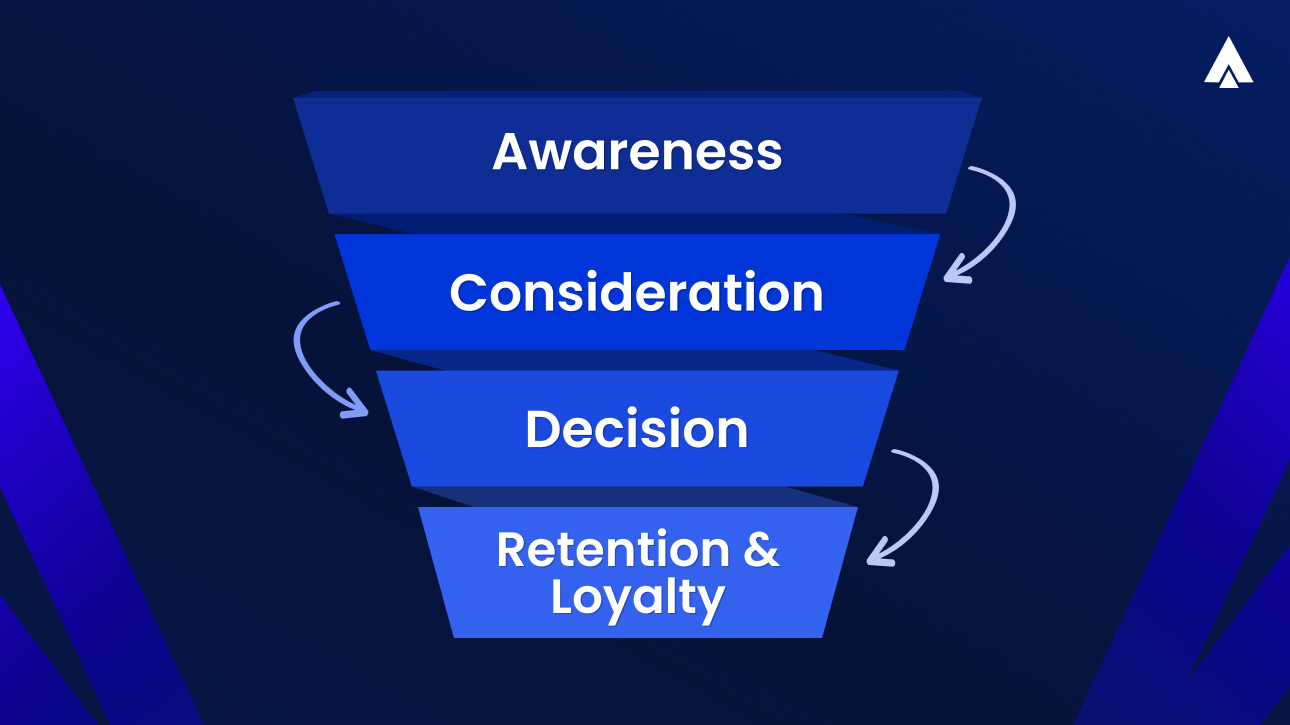

Today’s users demand seamless, speedy, and secure experiences. To keep up, you must craft a strategic, data-driven journey that takes them from awareness to loyalty.

The goal should be to engage the right audience at the right time with the right tools. In this blog, we’ll break down the essential steps to building a high-impact customer journey tailored for BFSI brands.

Read on to discover how you can drive trust, engagement, and conversions at every stage.

Awareness Stage (Top of Funnel – TOFU)

At the top of the funnel, your potential customers are just beginning to recognize their financial needs. This is the stage where you must establish authority through all possible channels.

As a general rule, customers are cautious about choosing financial services. This is primarily due to concerns about security, regulatory compliance, and financial stability. Unlike e-commerce or retail, where impulse buying is common, financial decisions require thorough research and trust-building.

Other than that, financial services generally have longer decision cycles. Customers often compare multiple providers before making a decision. They may also not fully understand financial instruments. Which means, they are likely to rely on recommendations from their peers.

So, how can you break all these barriers?

- Targeted Outreach: You need to target precisely based on demographics, financial behavior, and risk appetite. This will be monumentally beneficial as compared to broad, generalized marketing.

- Trust-First Approach: Instead of aggressive selling, first establish credibility through content and compliance certifications. You can opt for thought leadership, case studies, and customer success stories.

- Education-Driven Marketing: Create informational content to nurture leads effectively. A few examples include investment guides, insurance comparisons, and loan eligibility checklists.

- Multi-Channel Engagement: The optimal strategy is to combine digital marketing with traditional trust-building channels. You can opt to pair referrals, relationship banking, and financial advisory sessions with email and social media marketing for higher conversion rates.

Consideration Stage (Middle of Funnel – MOFU)

At this stage, your potential customers are evaluating financial ivr service provider. Your focus should be to ensure that they select you out of all the competitors. Hence, the content you put out needs to be a bit more user specific as compared to the TOFU stage. Transparent information, personalized insights, and seamless digital experiences can guide your prospects toward a decision.

Here are the channels that can help you connect with your target audience at MOFU stage:

- Email Nurturing Campaigns: You can send automated emails with case studies on BFSI success stories, customer testimonials, and industry reports.

- Stronger Privacy & Security Measures: Customers need reassurance that their financial data is protected. For that, you need to incorporate clear security messaging in all your lead-generation efforts.

- Personalized Content & Tools: Offer financial planning calculators, credit score checkers, mortgage estimators, and insurance premium calculators.

- Live Chat & Chatbots: Provide instant assistance for financial queries, policy details, and eligibility checks.

- Lead Magnets & Gated Content: You can place lead magnets on your webpages or blogs with significant traffic. Offer downloadable whitepapers on investment strategies, tax-saving tips, and digital banking trends.

- Remarketing Ads: Retarget website visitors with BFSI-specific personalized offers, such as limited-time low-interest rates on loans or bundled insurance packages.

Decision Stage (Bottom of Funnel – BOFU)

At the bottom of the funnel, your potential customers are ready to take action. They have evaluated all the available options. However, despite understanding the solutions in detail, they still require reassurance. This is where you can eliminate friction by providing compelling incentives.

Here’s what can help you take a potential BOFU customer to a lead:

- Product Demos & Consultations: Offer free consultations with financial advisors, banking representatives, or investment specialists.

- Limited-Time Offers & Discounts: You can also offer exclusive deals such as zero processing fees on loans, discounted insurance premiums, or free first-year credit card membership.

- Seamless Digital Onboarding: Ensure a seamless, paperless application process for loans, savings accounts, etc. Use e-KYC verification for quick and secure customer onboarding.

Retention & Loyalty Stage

The strategies mentioned above can help you take a potential customer to a lead. But what happens after that? Once a customer is onboarded, your focus should shift to retention aka maintaining engagement by providing continued value.

This is one of the most important stages, especially from a revenue and customer experience standpoint. According to a study, retaining a customer costs you 7x less than acquiring a new one. Moreover, existing customers are responsible for up to 65% of your revenue.

Here’s how you can ensure maximum customer retention:

- Personalized Financial Recommendations: Use AI-driven insights to suggest relevant investment opportunities, premium banking services, or upgraded insurance plans.

- Loyalty & Referral Programs: Reward customers for long-term relationships, premium account upgrades, or referrals to family and friends.

- Proactive Customer Support: Provide 24/7 assistance via call centers, AI chatbots, and self-service portals for instant issue resolution.

- Exclusive Customer Benefits: Offer premium financial services such as priority banking, concierge support, or specialized investment advisory for high-value clients.

Steps to Build a Full-Funnel Customer Journey

Now that you have a grasp on what your customers are thinking at various stages of their journey, let’s understand the steps you can take to build a robust customer funnel:

Step 1: Define Your Target Audience & Segmentation

As a BFSI business, you cater to diverse customer segments, each with unique financial needs. So, drawing them in will require targeted efforts. You can begin by identifying key personas, such as:

- Retail Banking Customers: individuals looking for savings accounts, loans, credit cards.

- High-Net-Worth Individuals (HNWIs): those who are seeking premium banking and wealth management.

- SMEs & Enterprises: the segment that requires business loans, corporate banking, and insurance.

- Investors: people interested in mutual funds, stock trading, and retirement planning.

Step 2: Identify Communication Touchpoints

A touchpoint is any moment where customers engage with your product/ service or your cloud communications solution. Their experiences at these interactions influence their perception of your brand and determine further plan of action.

Popular touchpoints in the BFSI industry contain online banking, mobile apps, customer support, or in-branch visits. Every touchpoint presents a valuable opportunity for you to impress customers with a smooth experience, turning them into dedicated advocates.

Here’s how you can pinpoint key touchpoints:

- Gather insights on how customers discover your business through surveys and interviews.

- Use tools like Google Analytics to track website traffic sources and understand where visitors are coming from.

- Map the customers’ footprints across all your digital platforms and gather insights.

- Track customer engagement, feedback, and queries across social platforms to identify key digital touchpoints.

- Analyze call logs, chat transcripts, and email inquiries to find out common touchpoints where customers seek assistance.

Step 3: Optimize Engagement & Personalization

Once you’ve identified key touchpoints, the next step is to personalize interactions. Your customers are expecting experiences that cater to their financial goals and preferences.

Here’s how you can personalize interactions for better engagement:

- Use customer data to offer customized recommendations, financial advice, or investment insights.

- Ensure consistency across email, SMS, WhatsApp, chatbots, and voice support to provide a unified experience.

- Optimize user interfaces for easy navigation, self-service options, and intuitive workflows.

- Streamline processes such as loan approvals, claim settlements, and KYC verification to reduce friction.

Step 4: Strengthen Trust & Compliance

Trust is a cornerstone of customer relationships. Strengthening security measures and ensuring regulatory compliance can significantly impact your customers’ confidence and improve retention.

Here are the key strategies to help you build trust:

- Implement end-to-end encryption, multi-factor authentication, and fraud detection systems on customer portals and individual accounts.

- Adhere to industry standards such as RBI, SEBI, IRDAI, GDPR, and PCI DSS to protect customer data.

- Clearly outline terms, fees, and policies to eliminate confusion and build credibility.

- Provide real-time transaction alerts, fraud detection tools, and dispute resolution support.

Step 5: Measure, Analyze & Improve

Continuous improvement is crucial for optimizing your plan. Measuring customer interactions and consistently refining your approach ensures long-term success.

Here’s how you can evaluate and enhance your business performance:

- Monitor metrics like customer acquisition cost (CAC), retention rate, Net Promoter Score (NPS), and churn rate.

- Regularly collect and analyze feedback from surveys, reviews, and complaints to identify areas of improvement.

- Use AI-based analytics and predictive modeling to refine customer segmentation and marketing strategies.

- Experiment with different communication approaches, offers, and service enhancements to determine what resonates best with your customers.

Stay ahead of the curve in the BFSI industry! Our blog post covers the key takeaways from the BFSI Confex & Awards 2025, including insights from Acefone. Read it here- BFSI Confex & Awards

Final Word

A well-structured journey can help you attract, nurture, and retain customers effectively. The BFSI-specific strategies mentioned above can help you build a leakage-proof funnel and drive sustainable growth.

However, achieving seamless communication across all stages of the funnel requires a robust, unified platform. UCaaS solutions like Acefone empower BFSI businesses with secure, scalable, and omnichannel communication tools. With our 300+ advanced functionalities, you get everything from state-of-the-art HPBX system to industry-leading CRM integrations.

Our comprehensive data analytics can help you get key insights for frictionless interactions. With all this and more, you can enhance customer experiences, ensure compliance, and drive higher conversions.

Want to future-proof your BFSI communication strategy?