Compliance with industry laws, government regulations, and internal policies is more than just a checkbox—it’s a necessity. Every violation, no matter how minute, can cost you time, money, and other resources.

Did you know that customer data breaches alone cost businesses an average of $4.45 million per instance?

Many of these breaches stem from overlooked vulnerabilities in business communication system. You could be sending unsecured emails, making unencrypted VoIP calls, or mishandling customer data without even knowing.

Every minor violation can result in financial penalties and expose sensitive information to cybercriminals. These compliance risks have the potential to cause reputational damage and operational disruptions.

Today, we uncover some of the hidden compliance risks lurking in your communication channels and explore effective strategies to stay compliant and secure.

What Is Compliance Risk?

Compliance risk includes the legal penalties, financial loss, or reputational damage you might face if you fail to follow certain regulations. They can be your country’s law, the standards set by a regulating authority like the FCC or your company’s internal policies. The risk applies to all organizations, whether public or private, profit or nonprofit, state or federal.

Managing HIPAA compliant voip risks requires staying informed about industry regulations, as well as state and national standards. Regulatory agencies like the Occupational Safety and Health Administration (OSHA) frequently update guidelines across various industries. Meanwhile, laws such as the Health Insurance Portability and Accountability Act (HIPAA) are examples of industry-specific regulations that continuously evolve.

Why Compliance Risk Is a Real Threat?

Ignoring compliance requirements isn’t just risky—it can be detrimental to your company’s survival. Here are the key reasons why compliance risk is a significant threat:

1. Legal & Liability Concerns

Failure to comply with legal mandates can result in lawsuits, sanctions, and even criminal charges. Regulatory bodies such as the Telecom Regulatory Authority of India (TRAI) or the General Data Protection Regulation (GDPR) authorities impose stringent rules. Non-compliance can lead to long-lasting legal battles.

To stay safe, you must ensure your operations align with such international and regional laws. A single misstep could lead to litigation and disrupt your operation leading to financial losses.

2. Data Security

If you haven’t been living under a rock, you know that data breaches make headlines almost every day. Hence, complying with data protection laws has become even more crucial. Regulations such as the California Consumer Privacy Act (CCPA), and India’s Digital Personal Data Protection Act (DPDPA) require strict security measures to safeguard customer data.

Failing to comply with these regulations can lead to massive data leaks, resulting in fines, customer distrust, and loss of business. As cybersecurity threats are evolving, it has become even more important to stay on top of the latest security standards.

3. Business Reputation

Your company’s reputation is one of its most valuable assets. Compliance failures—such as unethical business practices or fraud—can lead to negative publicity, loss of customer trust, and a damaged brand image.

Rebuilding a tarnished reputation takes years, and in many cases, companies struggle to recover from compliance-related scandals.

To avoid this, you need to maintain transparency and adhere to regulations. It is a sure shot way of build long-term credibility and customer loyalty.

4. Financial Penalties & Revenue Loss

Regulatory fines for non-compliance can be staggering. Businesses that fail to meet legal obligations can face millions in penalties, impacting their financial stability.

For example, GDPR fines can reach up to €20 million or 4% of a company’s global revenue, whichever is higher. These penalties, coupled with potential lawsuits and compensations, can significantly affect profitability.

Moreover, non-compliance can result in loss of business partnerships and revenue setbacks.

5. Operational Disruptions

Regulatory violations often trigger audits, investigations, and enforced changes in business processes. Such interventions can cause severe operational disruptions, leading to inefficiencies and delays in service delivery.

For instance, non-compliant businesses may be forced to halt operations until corrective measures are implemented. This not only affects productivity but also damages customer relationships.

Common Compliance Failures and Their Consequences

Now that you understand in detail about compliance risks and their consequences, let’s look at some that might be lurking in your communication systems.

1. Who’s Speaking? The Mystery of Unauthorized Channels

Using unauthorized communication channels, such as WhatsApp, LinkedIn, or personal emails, poses a significant compliance risk for businesses. Regulatory bodies like the SEC, GDPR, and FINRA require senders to properly record and preserve commercial communications for better transparency and accountability.

If your employees use unapproved platforms,

Let’s understand this better with the famous case of SEC penalty received by big investment advisors and broker-dealers, including Charles Schwab.

Here are the case highlights:

- The SEC penalized 12 investment advisors and broker-dealers, including Charles Schwab, for sending messages via unauthorized communication channels like WhatsApp, LinkedIn, and Facebook Messenger.

- Blackstone received the highest fine of $12 million, followed by KKR at $11 million and Charles Schwab at $10 million. PJT Partners was fined $600,000, the smallest penalty, due to self-reporting its violations, though the firm did not respond to comment requests.

- The enforcement is part of a broader SEC effort, which has resulted in billions in fines. All this to ensure firms maintain proper communication records for transparency and regulatory compliance.

How to avoid such penalties for your business?

- Mandate employees to use company-sanctioned tools for all business-related communication.

- Educate employees on regulations, risks, and the consequences of using unauthorized channels.

- Establish clear rules against personal messaging apps for business and enforce disciplinary measures.

- Create a culture where employees can report accidental violations without fear of punishment.

- Conduct regular checks to detect and address unauthorized communication practices.

-

To Call or Not To Call

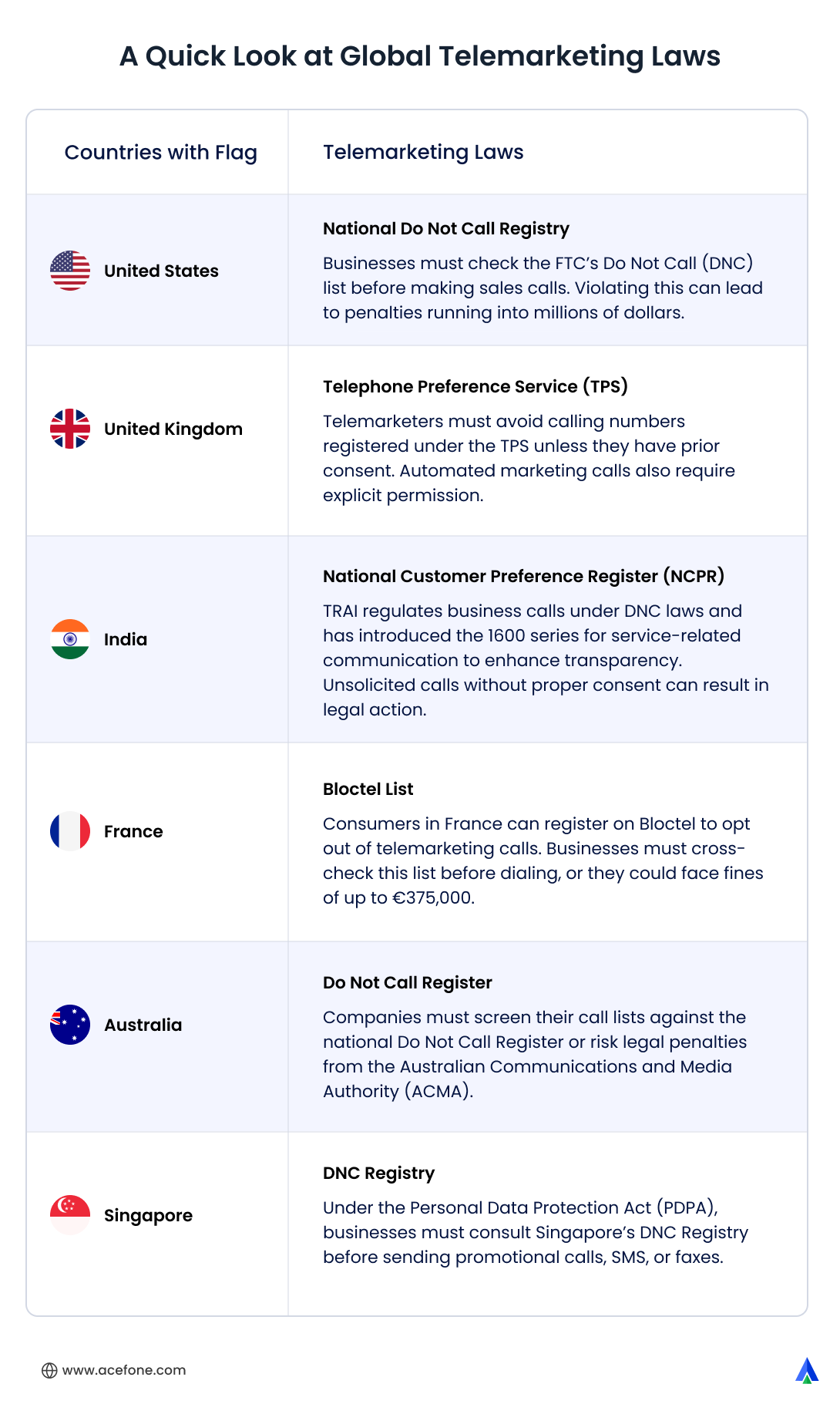

Telemarketing can be a powerful tool for growth, but it comes with a web of compliance requirements that you might happen to overlook. One such example is the Do Not Call (DNC) regulations, designed to protect consumers from receiving unwanted calls and messages. If your business contacts customers without adhering to these rules, you could face hefty fines—even if you had good intentions. Several countries have strict telemarketing laws, and staying compliant means knowing the rules in every region you operate in.

Suggested read: 160 area code

How to stay compliant:

- Automate DNC Scrubbing – Use compliant call management solutions that automatically check customer numbers against local and international DNC lists before dialing.

- Stay Updated on Global Compliance – Telemarketing laws change frequently, so ensure your team is aware of the latest regulations in every region you operate.

- Get Proper Consent – Always obtain clear, recorded consent from customers before sending them marketing messages or calls.

-

Lost in Transmission: A Broken Paper Trail

A broken communication paper trail occurs when businesses fail to properly record their official communications. Unbeknownst to you, sometimes, your employees might connect with customers through off-channel communication methods—such as texting, WhatsApp, LinkedIn messages, or personal emails.

When not logged, these messages create a compliance gap for regulators and auditors. They make it difficult for regulators to track discussions, investigate potential misconduct, or ensure adherence to financial laws.

One such major violation occurred when 6 credit-rating firms, including Moody’s and S&P Global Ratings, faced civil penalties for failing to maintain communication records. The SEC charged these firms for not properly recording texts and WhatsApp messages that their employees sent to the customers, a mistake that hindered regulatory oversight.

Moody’s and S&P each paid $20 million, Fitch paid $8 million, A.M. Best paid $1 million, HR Ratings de México paid $250,000, and Demotech paid $100,000. The firms also acknowledged the issue and committed to improving compliance policies. Four firms (Moody’s, S&P, Fitch, & HR Ratings) agreed to hire compliance consultants, while A.M. Best and Demotech were exempt due to their early compliance efforts.

Here’s what they could’ve done differently to avoid this violation:

- Use UCaaS tools that automatically capture and store phone calls, messages, and emails, ensuring no messages are lost or deleted.

- Clearly define and communicate policies that prohibit off-channel communications, with disciplinary actions for non-compliance.

- Educate employees about the importance of maintaining a clear audit trail.

- Regularly review communication records and take corrective action before violations occur.

- Partner with a compliant service provider like Acefone for monitoring, tracking, and managing all communication channels, and avoid accidental violations.

The Hidden Compliance Risks in Your Business Communication System

-

Locked Out or Leaked? Customer Data Breaches

Data breaches, commonly led by a ransomware attack, pose a dual threat: you being locked out of your own systems and having sensitive data leaked. The attacks can encrypt critical data, disrupting operations and causing significant downtime. If customer information becomes inaccessible, you may also violate compliance regulations.

On the other hand, data theft exposes personal details—such as names, addresses, and financial records—to cybercriminals. This can lead to identity fraud and penalties under regulations like GDPR, HIPAA, and CCPA.

Both scenarios can result in hefty fines, lawsuits, and reputational damage. To mitigate these risks, you must implement robust security measures. Responding swiftly to breaches is also crucial to protecting customer trust.

Here is how Rite Aid, a leading US-based drugstore chain handled a massive customer data breach:

In June 2024, the RansomHub ransomware group accessed Rite Aid’s systems, stole data of 2.2 million customers, and encrypted files. The stolen data included personal and identification details of customers who made purchases in mid-2017.

This resulted in multiple lawsuits, which were ultimately consolidated into Margaret Bianucci v. Rite Aid Corporation. The allegations were negligence, delayed breach notifications, insufficient credit monitoring, and failure to disclose key details.

How did Rite Aid Deal with this?

Rite Aid agreed to a $6.8 million settlement covering claims, legal fees, and other expenses. Affected customers could claim up to $10,000 for documented expenses or opt for a cash payment based on the remaining funds. As part of the settlement, they committed to strengthening their cybersecurity measures to prevent future breaches.

The settlement received preliminary court approval on March 4, 2025, with a final approval hearing set for July 17, 2025.

Acefone: Your Compliance Partner

Compliance risk is not something you can afford to overlook. Legal issues, financial penalties, data breaches, and reputational damage can have long-term consequences. Staying compliant isn’t just about avoiding fines—it’s about ensuring sustainable growth, maintaining customer trust, and protecting your company’s interests.

Acefone makes compliance effortless by providing secure, and regulation-compliant cloud communications solution. With built-in call recording, data encryption, and automated monitoring, our platform ensures that your business stays aligned with industry regulations. From protecting sensitive information to maintaining detailed audit trails, Acefone helps you mitigate risks while focusing on what matters most for you— growing your business with confidence and reliability.